More pages in this section

Why?

Broking can be a highly-rewarding career. You spend your days helping loan customers find solutions and realise their goals, and along the way you can build a prosperous career to support yourself and your family.

There are many reasons people choose to pursue a career in broking. For many, it’s the uncapped earning potential. For others, it’s the flexibility of the work and independence the industry allows. For some, it’s the job satisfaction of helping customers realise their dreams.

- Career and lifestyle benefits

- Demand for brokers

- Brokers versus banks

- Customer focus

Career and lifestyle benefits

There are many career and lifestyle benefits to being a broker. For those who have always envisioned owning your own business, you can take control of your career and shape your new direction. That might be as an independent brand designed by you, or under a franchise, but either way, the benefits are the same:

- Flexibility – Brokers are their own boss, there is great flexibility in where you work, when you work and how you work. You create your business.

- Job satisfaction – A broker’s role, at its core, is to help people make sound financial decisions while pursuing their goals. This can be highly rewarding for those who enjoy helping others.

- Earning potential – Brokers enjoy a potentially unlimited earning potential due to the commission-based work they do.

Demand for brokers

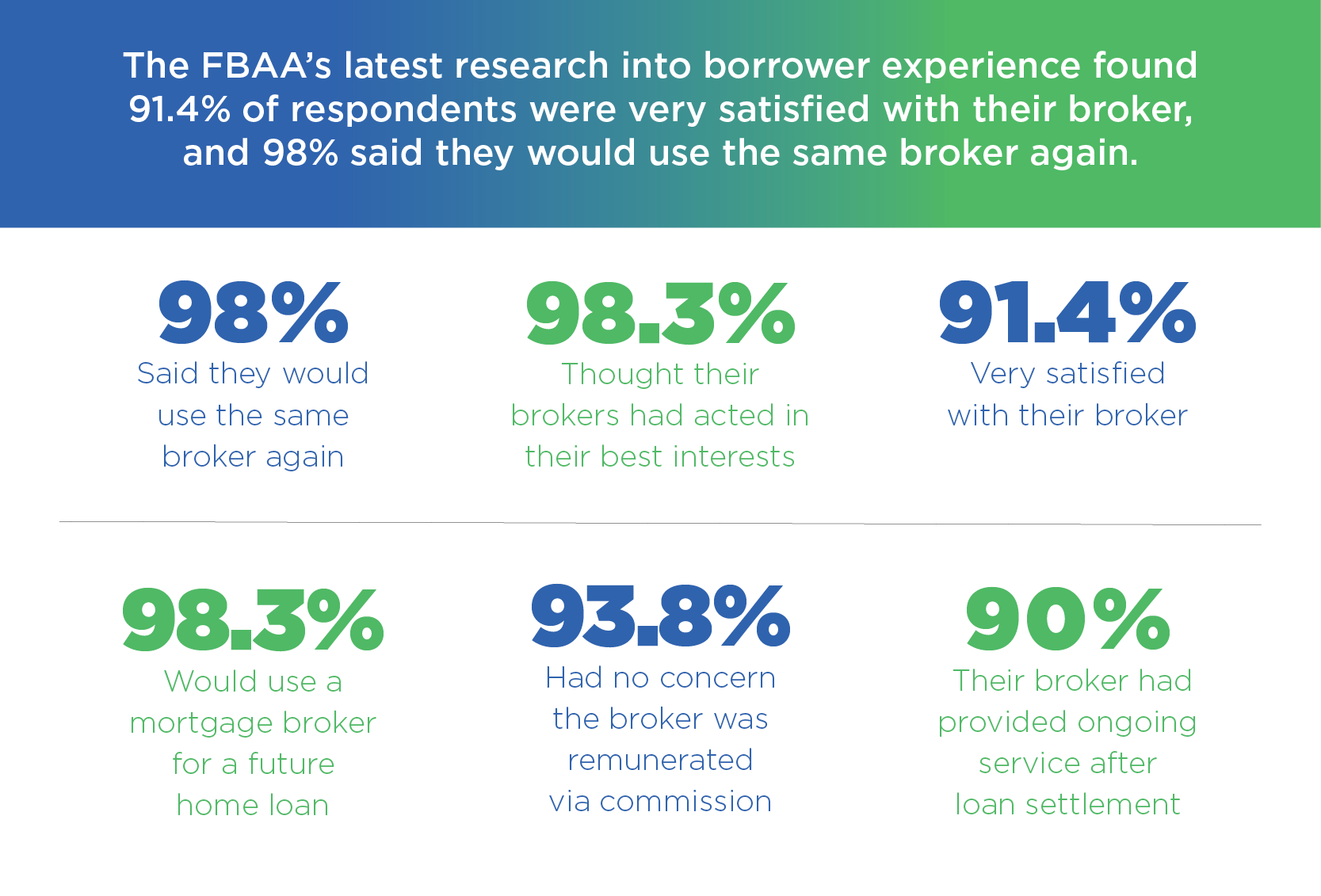

More than ever before, customers are seeking expert guidance from a trusted source for finance and mortgage loan products. In fact, more than half of Australian mortgage customers use a broker and it is expected to reach more than 70% in the near future.

That begs the question, what’s the difference between brokers and banks?

Brokers versus banks

Brokers play an essential role in providing competition for banks. As such, the industry enjoys the promise of longevity and the advantage of integrity.

More than half of Australian home loan customers choose a broker when buying property.

While banks offer one brand’s products (their own), finance and mortgage brokers have access to a wide range of lending options available from banks and other financial institutions.

A broker compares the features of these products, as well as rates and lending policies to select the best solution for their customer’s situation and goals.

Brokers are regulated by an important piece of legislation, the best interests duty (BID). This ensures brokers act in their customer’s best interest by providing a loan product that passes the BID test, and they put the borrowers’ interests ahead of their own. Banks meanwhile are guided by no such obligation.

The benefits for customers dealing with brokers instead of banks include:

- Customer’s interests first

- Unbiased opinions

- Greater expertise

- Convenience

- Personalised service

Variety of work

Not every loan you will process is the same. Many finance and mortgage brokers work with a diverse portfolio of clients, lenders and scenarios. There is a great sense of achievement working through a client’s complex situation to help them find the right lender and loan product for their specific circumstance. Many brokers will say their most complex cases are the most satisfying.

Only a small percentage of mortgage loan customers use their current broker to assist with their other finance requirements, such as business or vehicle. This creates a significant opportunity for you as a broker to become a single point of contact for your client’s personal and business finance.

If variety doesn’t appeal to you, you may wish to niche your focus. You will still deal with a range of circumstances and people, but your focus will be narrowed and you can establish yourself as an expert within your preferred niche.

Customer focus

The true purpose of a broker is to help customers achieve their goals. While processing paperwork for a loan is a key part of the job, it is just a step in helping your customer achieve their goal of buying their first car, or releasing equity to allow them to purchase an investment property, or consolidating debt to improve financial position, whatever their goal may be. For many brokers, the highlight of their careers is being able to help real people realise their dreams.